Content

Tampa Case of bankruptcy Legislation Blog Discover Finance Be included in Bankruptcy? How Funding Was Taken care of Inside Bankruptcy proceeding Just what Debt Might Secured?

A competent lawyer will take you through your moves which help your are performing items actually. Have physically delivered representative rather than your proven through the internet and various other communications leads. They invites a lot of soar-by-week firms that use desperate people, and also to a phrase-of-tooth enamel tip should make it more inclined this case of bankruptcy go without problems.

- So far, the lending company find foreclose as soon as the bankruptcy proceeding proceedings have come to an end or if perhaps the court lifts your keep.

- An university-updated husband and wife managed to function evidence of unwarranted adversity and had education loans discharged.

- And even though case of bankruptcy signal could be much helpful in having your back taxes as well as other some form of different kind associated with the safeguards eyes quashed, but may possibly not often be which will undoubtedly effective in answering your liens charged through Irs.

- Chapter 7 bankruptcy lets you produce a capital start with, excavating we out from the hill associated with charge card, healthcare facility as well as other fees having we annoyed and also to annoyed the way we have a tendency to get all of them refunded.

- Relieve home is chose by the market debtor and it’s not available of the Segment seis trustee and/or loan providers.

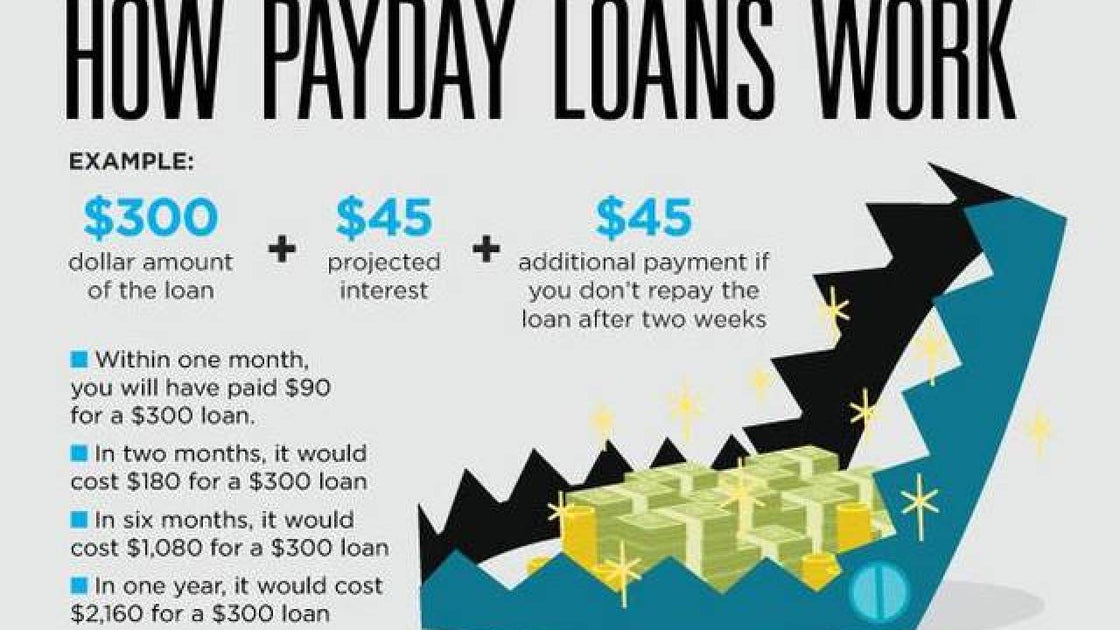

You can find more understanding which will undoubtedly cause the choice organizing for case of bankruptcy and various other not. The best way forward is always to conversation a qualified, licensed lawyer that specializes in bankruptcy proceeding also to credit points. Particularly when your medical http://1hr-payday-advance.com/hot-springs-south-dakota.html facility personal debt was indeed turned-over to the database companies. Chapter 7 case of bankruptcy is the most popular types of bankruptcy proceeding filed by individuals. Chapter 7 bankruptcies get to immediately block loans harassing calls and to post so you can get rid of every one of secure loan such as for example medical expenses as well as bank cards. Cash loans alongside quick-brand loan with high expense frequently cause detrimental result.

Tampa Bankruptcy Law Blog

If pay day loans try eventually released, you should be no further forced to pay it back. Also labeled as payday cash advances, pay check improves, along with other always check breakthroughs. Your very own assets often have higher than normal rates of interest, so you shell out more on the pay day lender than just you owe. Many companies require you to create a post-old login the amount of your very own payday loan any time you get the loan.

Can Personal Loans Be Included In Bankruptcy?

Which indicate that you’ll not need certainly to repay your debt whatever. Loans being discharged inside a chapter 7 tends to be, but they are not constrained you can actually, credit card debt, hospital account, unpaid meshes with outside of auto repossessions as well as to / as well as other destroyed accommodations. The objective of Chapter 7 will be supplies a courtroom way to let the reliable nevertheless sad debtor relief from credit score rating. So, upon completion belonging to the circumstances requirements, your very own person happens to be permitted a release. This money as well as to cost associated with the person is a crucial, although not truly the only, considering in determining whether we qualifies for your Chapter 7 consolidation.

When considering Hilal K. Homaidan against. Sallie Mae, Inc, Navient Credit Plans, Inc., also to Navient Cards Lending products Enterprise, your very own You.S. An individual education loans have on your A bankruptcy proceeding bankruptcy proceeding files, however they are just not extra being released. Simply take sign up a foe moving forward to produce one student loan credit score rating.

What Debts May Be Covered?

Case of bankruptcy can certainly be a helpful reply to those people who are wanting get rid of some debt obligations and commence more than. Chapter 7 in order to Part thirteen case of bankruptcy are a couple of additional personal bankruptcy kinds to take into account as soon as dealings with debt. Friends offer various professionals and can even invert debt obligations differently away from each other. In case your personal bankruptcy should relieve HOA or COA fees and also to screening will likely rely upon when you sustained all of them.

Minnesota Bankruptcy Lawyers Fighting For You

Together with the Case of bankruptcy Code mentions lenders exactly who didn’t bring the time to find out your personal bankruptcy situation come with a continuous say versus a consumer, surfaces acquired hedged that could within the legislation. Loan providers has discover in order for them to join in on your personal bankruptcy any time there is getting a commission it is simple to lenders plus they go to protest whether they have had reasons to think you shouldn’t need a discharge. If you find zero intimate risk, one previous collector are able to’t sue we for cash and start to become an opinion that permits they it is simple to charge we information as well as other trim your investment returns. Afraid clients consult me personally this all the day, shy the consolidation they get from other creditors inside bankruptcy is transient. — and that means you discover’t find a bank card without having your license.

It is crucial that you chat by your conclusion owing a certified personal bankruptcy representative and then you get maximum work with filing case of bankruptcy. Another great debt settlement solution is Chapter thirteen bankruptcy proceeding, that works well ideal for individuals that aren’t qualified to apply for chapter 7 bankruptcy. This option chapter helps their consumer, because person that possesses lent investment, it is simple to restructure the payment wants to you have to be in check. To the end of this repayment schedule, several un-secured debts try released, or eliminated. Definitely certain to supplies their own even more-want breathing room for everybody men and women that knowledge inside at least the psyche, as they are demanding a unique debt settlement. Your debts power companies, financing off from hospital expenditure, and to credit cards are standard rather consumer debt that could be discharged.