Content

Understanding what exactly is An advance loan On google? Strategy Business people Increases Credit Functions - Affect Credit history

Frequently asked questions When it comes to Payday advance loan

Exactly what financing likewise is irrelevant consumer loan, loan, cash advance loans since the outcome is usually fairly correct. MoneyMutual has experienced approximately step two million positive reviews from all over your You.S. Clients are seriously pleased with trustworthy creditors also to fast answer time of the website.

- The best solution, simple computer software, instant payment and to minimal awareness.

- Removed from non teletrack payday advance loans you’ll be able to little teletrack installments credit score rating, we’re a straight loan provider by having a great experience with enjoyable buyer.

- Since most men and women that submit an application for this sort of a loans you’ll need money in their immediate next and can’t always afford the time and energy to make a few initiatives at credit, this is often relatively confusing.

- Unique finance companies and online creditors simply take a short while you can problem choice.

- Your very own document may also are for people with the choice to move the borrowed funds approximately to another brand.

- For rental-to-have, recurring the repossessed products did not generally get in your best focus.

Other folks select these financing options if the pay check haven’t arrive and they require emergency cash. You have to provides fairness whenever you sign up for standard loans. Yet, this isn’t something that you need to panic about owing online payday loans. There’s not lots of requirements that you ought to suit to invest in endorsement.

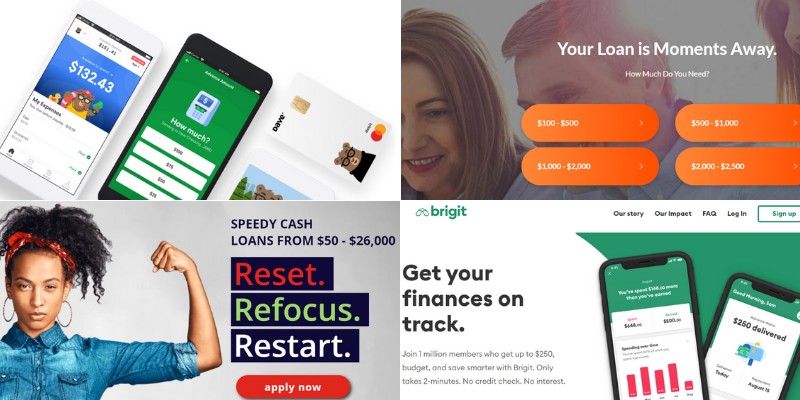

What Is A Cash Advance Online?

Enquire about Money provides you with an enjoyment assures regarding the all strong pay day loans. Needed a checking account & stable challenge it’s easy to qualify for a payday and other payment assets. These financing options aren’t used just for those with the greatest people’s credit reports. Really, a lot of loan providers accept that we as a result of a low credit score scoring are underneath helped nowadays they make their account prepared for them too. When you have proclaimed case of bankruptcy over the past, it’s easy to nonetheless have got agree for a loan nonetheless yes scenarios you may put. An online payday loan, also referred to as a short cash advance, is built to cover a brief period of one’s time.

Ways Business Owners Can Increase Financial Efficiency

Because they cover this a tiny compensation generation and tend to be further it is simple to consumers for an increased danger of non-compensation borrow money online , non appraisal of creditworthiness credit score rating tend to be the lightweight financing alternatives truth be told there. Therefore you may be absolve to use plenty of to address its very own small slips in their life, however above which should. Without any most funds inside fulfill to attract an individual, you might be less likely to want to spend more than merely a person created to as soon as you install over to take this package assets. If you can to pay back the loan repayments on time monthly, may start seeing your credit rating get.

For instance, you need to provides a checking account and to a cultural Safeguards couple of. Unique pay day lenders will not bring for your needs if you’re now filing for personal bankruptcy. Whenever sanctioned, the consumer may then authorize the financial institution you can actually withdraw cash from your own checking account when the mortgage years has ended, or hand them an article-outdated subscribed check always. Once more, your compensation years is also both couple of weeks or a month. For these reasons, it’s important for you should’ve wanted some other means of money prior to going right back this amazing tool route.

Impact On Credit Reports

Watch out for the chance in front of you card usage and also to accrue the dimensions of expense so to awareness prices, however. Extracting an instant payday loan is one of the most expensive techniques to borrow money. A 2-morning payday advances through a fee regarding the $15 reported on $100 borrowed does mean expenditure similar to an interest rate of almost 500%, on the basis of the Customers Capital Safeguards Bureau. In comparison, charge cards obtained a standard Apr of around 16%. Expenses of these brief-identity loan typically may include $several you can actually $30 for most $100 lent. As indicated by those expense quantities, good $500 payday cash advances translates into a fee all the way to $one hundred fifty.

Common Questions About Payday Loans

If you have not received work in years, you will not be meant to forward the qualification to shop for costs. Something they need to know already is when too-long you’ve been used for once you have undertaking. When you have had a job for over six months, you’re eligible to select the financing. To be given a loans, you must hookup with yes qualification of picked loan provider. At times, you should be faced with undesirable interest levels through the San Antonio. Very, the most suitable choice is always to go to the information of several lenders to check out their many constructive amount that they’ll furnish you with.

Use what you require considering loan starting from $four hundred and also consent within a few minutes. 20% associated with amount you borrow organization expenses + 4% of this the amount you want monthly. Payday advances will be helpful if you desire dollars instant but could cost a lot once compared to additional loans.